Flexicap Funds vs. DIY Large–Mid–Small Cap Combos: Which Strategy Delivers Better Results?

- Shwealth

- Nov 19

- 3 min read

Flexicap funds have become a popular investment choice among investors who want exposure to midcap and smallcap segments without investing in dedicated midcap or smallcap schemes. These funds provide the potential for higher returns associated with mid and small caps, but with lower volatility and lower drawdowns than directly investing in those segments.

For investors who prefer not to time their allocations between large, mid, and smallcap categories, flexicaps also remove the burden—the fund manager actively decides the ideal allocation depending on market conditions.

In this blog, we evaluate how an investor’s returns would differ if they invested:

Directly in a flexicap fund, or

Created their own “Combo” portfolio by investing individually in largecap, midcap, and smallcap funds from the same AMC.

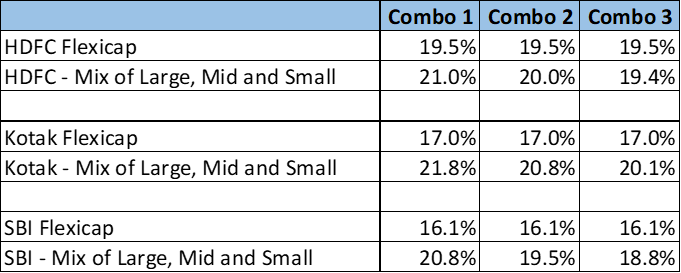

Combo 1: 1/3rd Investment each in Large, Mid and Smallcap scheme

Combo 2: 50% in Largecap, 30% in Midcap and 20% in Smallcap scheme

Combo 3: 60% in Largecap, 25% in Midcap and 15% in Smallcap scheme

Table 1: SIP Returns

Source: www.advisorkhoj.com, Shwealth data analysis

Since in the last decade, midcaps and smallcaps have provided higher returns, it is no surprise that lower the allocation to large caps the better chance the mix has of beating returns of the flexicap fund. For Kotak and SBI, even at only 40% allocation to midcap and smallcap (Combo 3), the Combo still beats the respective fund’s flexicap fund by a good margin. However; for HDFC, only Combo 1 (investing equally in all 3) provides a good margin over it’s flexicap fund.

Combo 1 and Combo 2 may seem impractical for conservative investors since they would not be willing to directly take over a 50% exposure in midcap and smallcap schemes. However; the created combo turns out to be less volatile than investing directly in the flexicap scheme. Over the 11 year period, Combo 1 and 2 as a portfolio would provide higher returns than the flexicap scheme 70% to 90% of times. In terms of drawdowns, each of the 3 combo can have a 5-10% higher drawdown than the flexicap scheme.

So, what strategy should an investor use? I always prefer to take exposure directly in large, mid and smallcap based on risk appetite and goals. For flexicaps I prefer Parag Parikh, due to the benefit of it providing international exposure as well as low volatility. However; as mentioned before, investors who do not want to experience the volatility and large drawdowns of midcap and smallcap funds, can look at flexicaps instead of adding funds in all three categories.

Conclusion

Flexicap funds offer convenience, and professional asset allocation. However, investors willing to stomach some additional volatility can potentially earn higher returns by creating their own diversified large–mid–small combo. Both approaches have merit; the right choice depends on the investor’s individual temperament, risk appetite and long-term goals.

Disclaimer- This is not a recommendation to invest in any of the funds mentioned in the article. Nothing in the article is my solicitation, recommendation, endorsement, or offer. If you have any doubts as to the merits of the article, you should seek advice from an independent financial advisor. Registration granted by SEBI, BASL membership, and NISM certification does not guarantee the intermediary’s performance or provide any assurance of returns to investors. Investment in the securities market is subject to market risks. Read all the related documents carefully before investing.

Comments